Par Value With Example

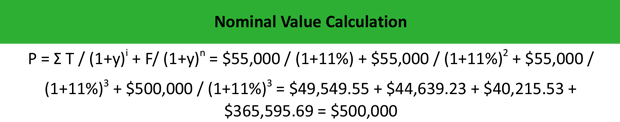

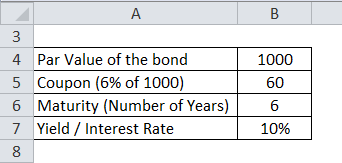

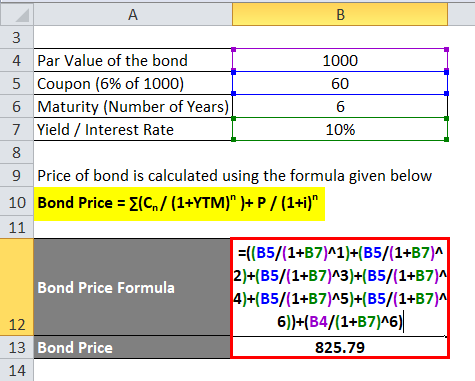

Each one of the 10 000 bonds issued has a 1 000 par value.

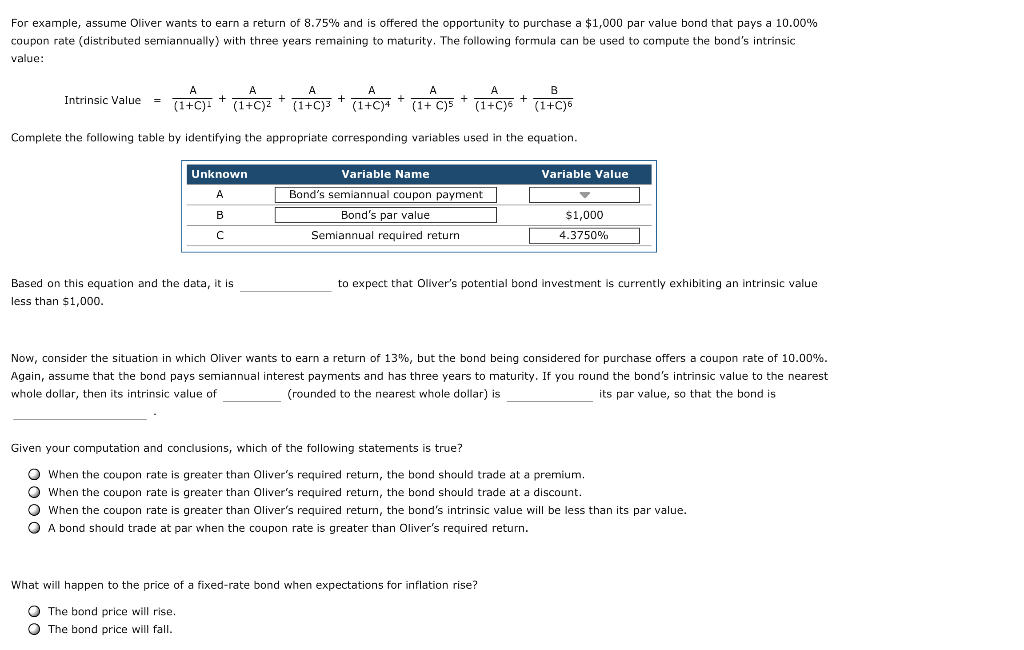

Par value with example. When each bond matures at a specified date the company will pay back the value of 1 000 per bond to the lender. For example if a bond certificate says 1 000 the face value is 1000. When each bond matures the borrower will pay back the par value of 1 000 to the lender. Bonds pay the face value at maturity and calculate coupons as a percentage of the.

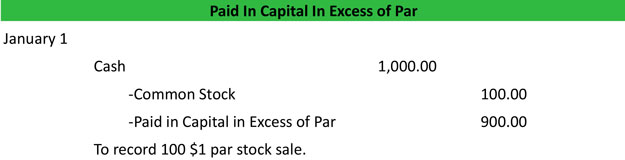

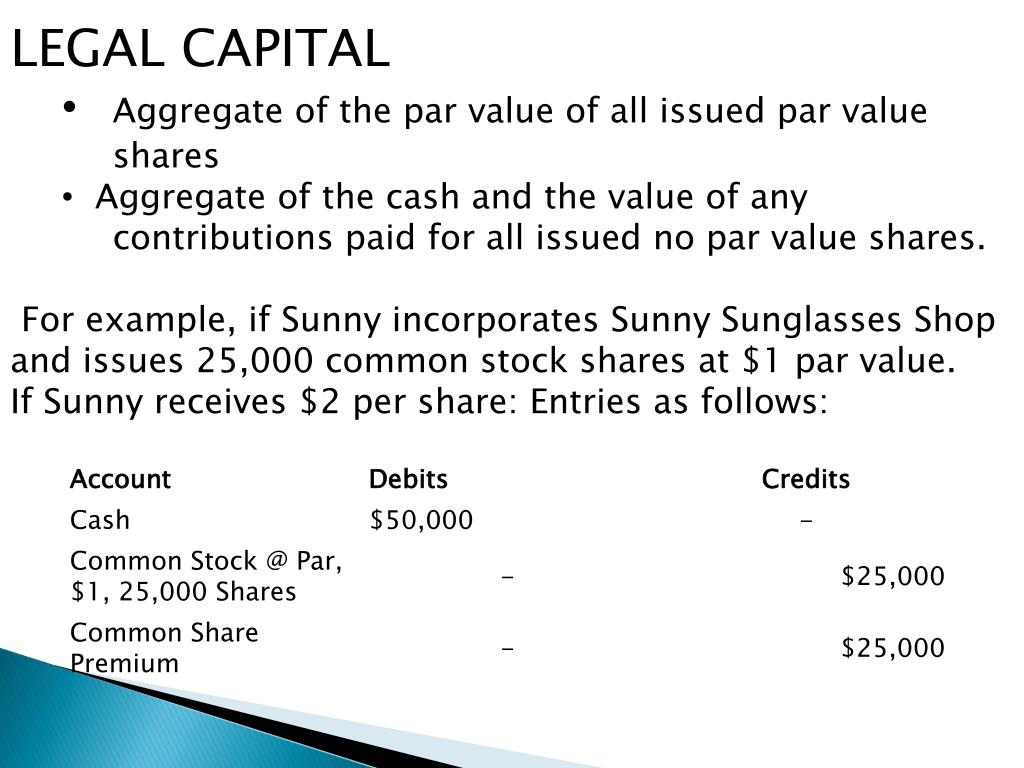

In other words when incorporation papers are made a par value is assigned saying the company stock is worth at least this much per share. Face value the amount of money stated on a bond or rarely a stock certificate. 1 no par stocks have no par value printed on their certificates. Let s assume company xyz issues 1 000 000 in bonds to the public.

Par value of shares also known as the stated value per share is the minimal shares value as decided by the company which is issuing such shares to the public and the companies then will not sell such type of shares to the public below the decided value. Assume that clinton company issues a bond to the public worth 10m. In other words it is the share nominal amount 1 0 1 or 0 001 mentioned on the stock certificate at the time. Par value is dollar amount assigned to each share of stock in the corporate charter when the corporation is formed.

Par value also called the maturity value or face value. Par value is important for a bond or fixed income instrument because it determines its maturity value as well as the dollar value of coupon payments. It may do so by issuing 1 000 bonds each with a 1 000 par value. What is par value of share.