Bond Par Vs Face Value

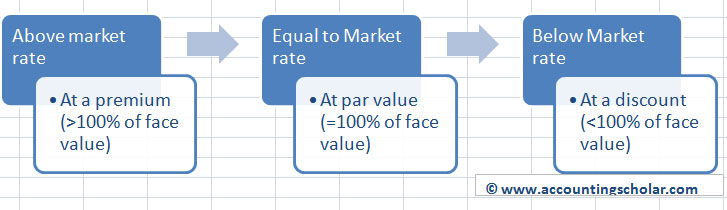

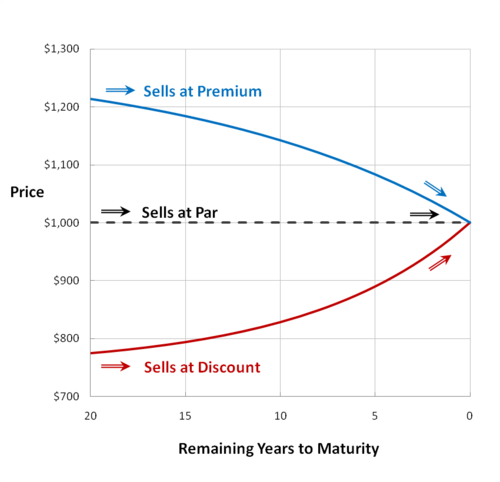

Par value the amount of the check you will receive at maturity bond prices fluctuate according to interest rates when interest rates go up bond prices go down when interest rates go down bond prices go up a bond is a loan made by an investor t.

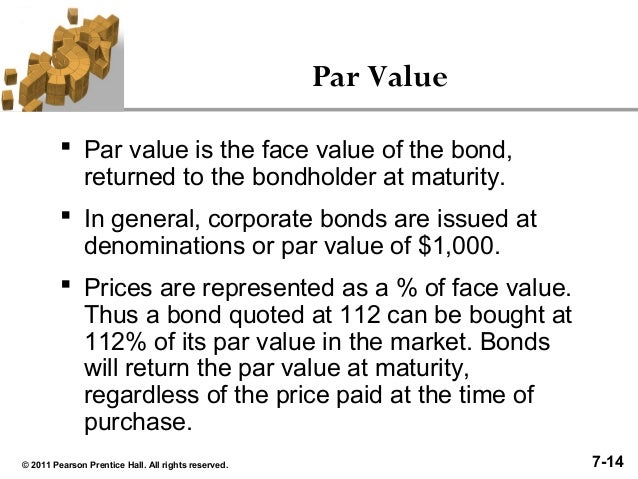

Bond par vs face value. This is in addition to the issuer paying you back the bond s face value on its maturity date. Book value is the net worth of the company per share. Par value and face value are most important with bonds as they represent how much a bond will be worth at the time of the bond s maturity. A bond is the financial equivalent of an iou.

In other words it is the amount that the share holder wi. Initial offerings are made available at par value of the face value to make them look attractive after listing and the stocks mostly open at a rate higher than the face value bringing profits for the investor. It is a static value determined at the time of issuance and unlike market value it doesn t fluctuate on a regular basis. Par value is the nominal or face value of a bond or stock or coupon as indicated on a bond or stock certificate.

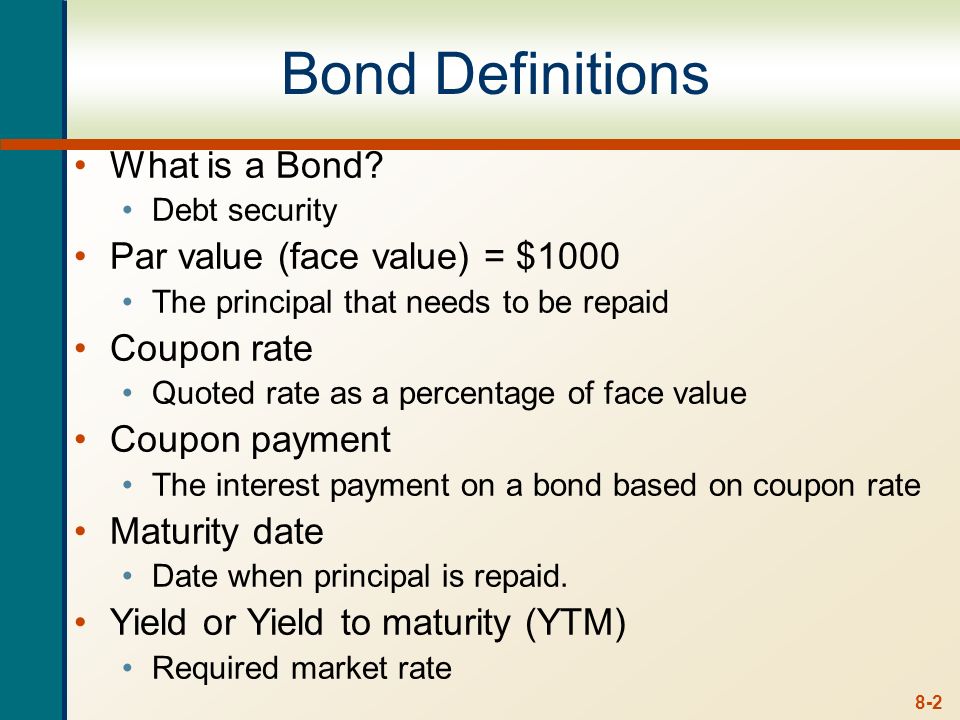

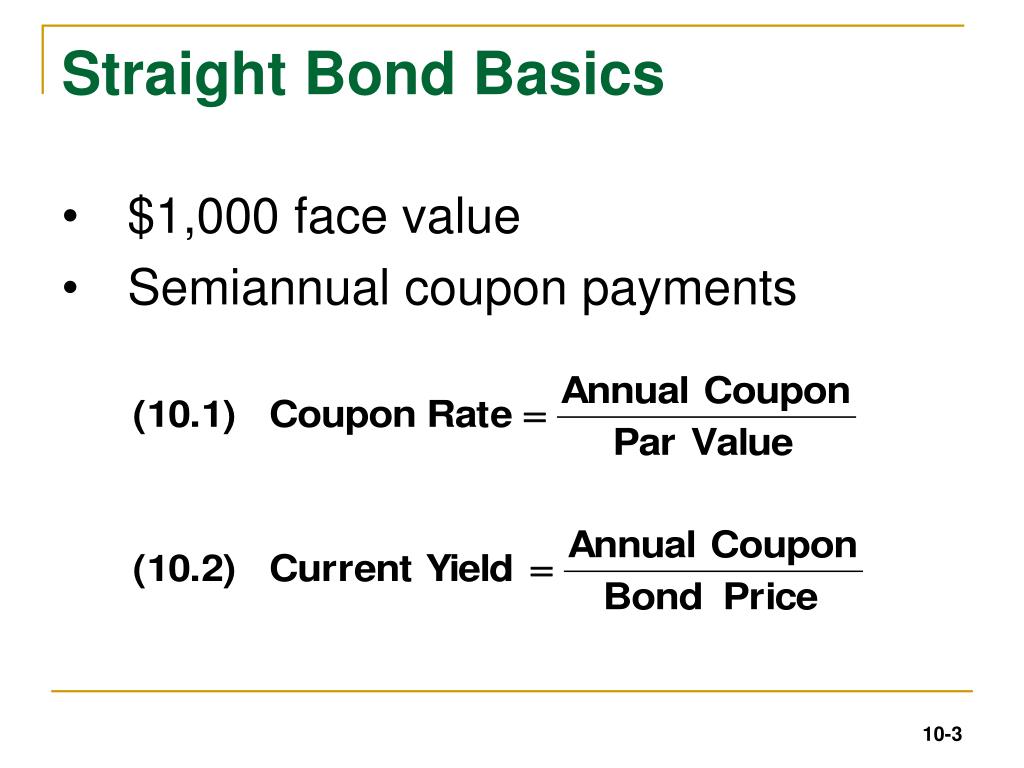

With stocks par value is a mostly arbitrary number. If you re purchasing a newly issued bond from a government or corporation the par or face value is the amount of money you invested usually 1 000. Face value and par value are investment terms that are related to bonds and stocks. So if a bond holds a 1 000 face value with a 5 coupon rate then that would leave you with 50 in returns annually.

A bond s par value. A bond s coupon rate is the rate at which it earns these returns and payments are based on the face value. Par value is also called face value and that is its literal meaning the entity that issues a financial instrument assigns a par value to it. That s how much money the bond issuer pays to the bond holder when the bond matures if you re holding a 1 000 bond from.

Par value vs face value. Red box market value blue box book value yellow box face value market value is the current price of the stock quoted on exchange.